The journal Nature recently published an opinion piece about a new concept for science funding called Research Impact Bonds (or RIBs).

Normally, when a government funds something, they can’t be sure it will work. They pay in advance, and have to guess whether a program will do what they expect, or whether a project will finish on time. Impact bonds are a way for them to pay afterwards, so they only pay for projects that actually deliver. Instead, the projects are funded by private investors, who buy “impact bonds” that guarantee them a share of government funding if the project is successful. Here’s an example given in the Nature piece:

For instance, say the Swiss government promises to pay up to one million Swiss francs (US$1.1 million) to service providers that achieve a measurable outcome, such as reducing illiteracy in a certain population by 5%, within a specified number of years. A broker finds one or more service providers that think they can achieve this at a cost of, say, 900,000 francs, as well as investors who agree to pay these costs up front — thus taking on the risk of the project — for a potential 10% gain if successful. If the providers achieve their goals, the government pays 990,000 francs: 900,000 francs for the work and a 90,000-franc investment return. If the project does not succeed, the investors lose their money, but the government does not.

The author of the piece, Michael Hill, thinks that this could be a new way for governments to fund science. In his model, scientists would apply to the government to propose new RIBs. The projects would have to have specific goals and time-frames: “measure the power of this cancer treatment to this accuracy in five years”, for example. If the government thinks the goal is valuable, they commit to paying some amount of money if the goal is reached. Then investors can decide whether the investment is worthwhile. The projects they expect to work get investor money, and if they do end up working the investors get government money. The government only has to pay if the projects work, but the scientists get paid regardless.

Ok, what’s the catch?

One criticism I’ve seen is that this kind of model could only work for very predictable research, maybe even just for applied research. While the author admits RIBs would only be suitable for certain sorts of projects, I think the range is wider than you might think. The project just has to have a measurable goal by a specified end date. Many particle physics experiments work that way: a dark matter detector, for instance, is trying to either rule out or detect dark matter to a certain level of statistical power within a certain run time. Even “discovery” machines, that we build to try to discover the unexpected, usually have this kind of goal: a bigger version of the LHC, for instance, might try to measure the coupling of Higgs bosons to a certain accuracy.

There are a few bigger issues with this model, though. If you go through the math in Hill’s example, you’ll notice that if the project works, the government ends up paying one million Swiss francs for a service that only cost the provider 900,000 Swiss francs. Under a normal system, the government would only have had to pay 900,000. This gets compensated by the fact that not every project works, so the government only pays for some projects and not others. But investors will be aware of this, and that means the government can’t offer too many unrealistic RIBs: the greater the risk investors are going to take, the more return they’ll expect. On average then, the government would have to pay about as much as they would normally: the cost of the projects that succeed, plus enough money to cover the risk that some fail. (In fact, they’d probably pay a bit more, to give the investors a return on the investment.)

So the government typically won’t save money, at least not if they want to fund the same amount of research. Instead, the idea is that they will avoid risk. But it’s not at all clear to me that the type of risk they avoid is one they want to.

RIBs might appeal to voters: it might sound only fair that a government only funds the research that actually works. That’s not really a problem for the government itself, though: because governments usually pay for many small projects, they still get roughly as much success overall as they want, they just don’t get to pick where. Instead, RIBS put the government agency in a much bigger risk, the risk of unexpected success. As part of offering RIBs, the government would have to estimate how much money they would be able to pay when the projects end. They would want to fund enough projects so that, on average, they pay that amount of money. (Otherwise, they’d end up funding science much less than they do now!) But if the projects work out better than expected, then they’d have to pay much more than they planned. And government science agencies usually can’t do this. In many countries, they can’t plan far in advance at all: their budgets get decided by legislators year to year, and delays in decisions mean delays in funding. If an agency offered RIBs that were more successful than expected, they’d either have to cut funding somewhere else (probably firing a lot of people), or just default on their RIBs, weakening the concept for the next time they used them. These risks, unlike the risk of individual experiments not working, are risks that can really hurt government agencies.

Impact bonds typically have another advantage, in that they spread out decision-making. The Swiss government in Hill’s example doesn’t have to figure out which service providers can increase literacy, or how much it will cost them: it just puts up a budget, and lets investors and service providers figure out if they can make it work. This also serves as a hedge against corruption. If the government made the decisions, they might distribute funding for unrelated political reasons or even out of straight-up bribery. They’d also have to pay evaluators to figure things out. Investors won’t take bribes to lose money, so in theory would be better at choosing projects that will actually work, and would have a vested interest in paying for a good investigation.

This advantage doesn’t apply to Hill’s model of RIBs, though. In Hill’s model, scientists still need to apply to the government to decide which of their projects get offered as RIBs, so the government still needs to decide which projects are worth investing in. Then the scientists or the government need to take another step, and convince investors. The scientists in this equation effectively have to apply twice, which anyone who has applied for a government grant will realize is quite a lot of extra time and effort.

So overall, I don’t think Hills’ model of RIBs is useful, even for the purpose he imagines. It’s too risky for government science agencies to commit to payments like that, and it generates more, not less, work for scientists and the agency.

Hill’s model, though, isn’t the only way RIBs can work. And “avoiding risk” isn’t the only reason we might want them. There are two other reasons one might want RIBs, with very different-sounding motivations.

First, you might be pessimistic about mainstream science. Maybe you think scientists are making bad decisions, choosing ideas that either won’t pan out or won’t have sufficient impact, based more on fashion than on careful thought. You want to incentivize them to do better, to try to work out what impact they might have with some actual numbers and stand by their judgement. If that’s your perspective, you might be interested in RIBs for the same reason other people are interested in prediction markets: by getting investors involved, you have people willing to pay for an accurate estimate.

Second, you might instead be optimistic about mainstream science. You think scientists are doing great work, work that could have an enormous impact, but they don’t get to “capture that value”. Some projects might be essential to important, well-funded goals, but languish unrewarded. Others won’t see their value until long in the future, or will do so in unexpected ways. If scientists could fund projects based on their future impact, with RIBs, maybe they could fund more of this kind of work.

(I first started thinking about this perspective due to a talk by Sabrina Pasterski. The talk itself offended a lot of people, and had some pretty impractical ideas, like selling NFTs of important physics papers. But I think one part of the perspective, that scientists have more impact than we think, is worth holding on to.)

If you have either of those motivations, Hill’s model won’t help. But another kind of model perhaps could. Unlike Hill’s, it could fund much more speculative research, ideas where we don’t know the impact until decades down the line. To demonstrate, I’ll show how it could fund some very speculative research: the work of Peter van Nieuwenhuizen.

Peter van Nieuwenhuizen is one of the pioneers of the theory of supergravity, a theory that augments gravity with supersymmetric partner particles. From its beginnings in the 1970’s, the theory ended up having a major impact on string theory, and today they are largely thought of as part of the same picture of how the universe might work.

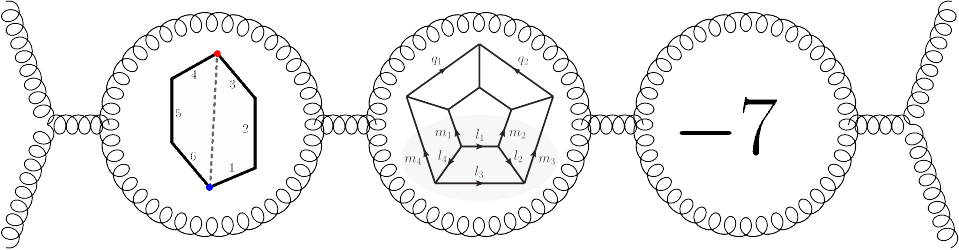

His work has, over time, had more practical consequences though. In the 2000’s, researchers working with supergravity noticed a calculational shortcut: they could do a complicated supergravity calculation as the “square” of a much simpler calculation in another theory, called Yang-Mills. Over time, they realized the shortcut worked not just for supergravity, but for ordinary gravity as well, and not just for particle physics calculations but for gravitational wave calculations. Now, their method may make an important contribution to calculations for future gravitational wave telescopes like the Einstein telescope, letting them measure properties of neutron stars.

With that in mind, imagine the following:

In 1967, Jocelyn Bell Burnell and Antony Hewish detected a pulsar, in one of the first direct pieces of evidence for the existence of neutron stars. Suppose that in the early 1970’s NASA decided to announce a future purchase of RIBs: in 2050, they would pay a certain amount to whoever was responsible for finding the equation of state of a neutron star, the formula that describes how its matter moves under pressure. They compute based on estimates of economic growth and inflation, and arrive at some suitably substantial number.

At the same time, but unrelatedly, van Nieuwenhuizen and collaborators sell RIBs. Maybe they use the proceeds to buy more computer time for their calculations, or to refund travel so they can more easily meet and discuss. They tell the buyers that, if some government later decides to reward their discoveries, the holders of the RIB would get a predetermined cut of the rewards.

The years roll by, and barring some unexpected medical advances the discoverers of supergravity die. In the meantime, researchers use their discovery to figure out how to make accurate predictions of gravitational waves from merging neutron stars. When the Einstein telescope turns out, it detects such a merger, and the accurate predictions let them compute the neutron star’s equation of state.

In 2050, then, NASA looks back. They make a list of everyone who contributed to the discovery of the neutron star’s equation of state, every result that was needed for the discovery, and try to estimate how important each contribution was. Then they spend the money they promised buying RIBs, up to the value for each contributor. This includes RIBs originally held by the investors in van Nieuwenhuizen and collaborators. Their current holders make some money, justifying whatever value they paid from their previous owners.

Imagine a world in which government agencies do this kind of thing all the time. Scientists could sell RIBs in their projects, without knowing exactly which agency would ultimately pay for them. Rather than long grant applications, they could write short summaries for investors, guessing at the range of their potential impact, and it would be up to the investors to decide whether the estimate made sense. Scientists could get some of the value of their discoveries, even when that value is quite unpredictable. And they would be incentivized to pick discoveries that could have high impact, and to put a bit of thought and math into what kind of impact that could be.

(Should I still be calling these things bonds, when the buyers don’t know how much they’ll be worth at the end? Probably not. These are more like research impact shares, on a research impact stock market.)

Are there problems with this model, then? Oh sure, loads!

I already mentioned that it’s hard for government agencies to commit to spending money five years down the line. A seventy-year commitment, from that perspective, sounds completely ridiculous.

But we don’t actually need that in the model. All we need is a good reason for investors to think that, eventually, NASA will buy some research impact shares. If government agencies do this regularly, then they would have that reason. They could buy a variety of theoretical developments, a diversified pool to make it more likely some government agency would reward them. This version of the model would be riskier, though, so they’d want more return in exchange.

Another problem is the decision-making aspect. Government agencies wouldn’t have to predict the future, but they would have to accurately assess the past, fairly estimating who contributed to a project, and they would have to do it predictably enough that it could give rise to worthwhile investments. This is itself both controversial and a lot of work. If we figure out the neutron star equation of state, I’m not sure I trust NASA to reward van Nieuwenhuizen’s contribution to it.

This leads to the last modification of the model, and the most speculative one. Over time, government agencies will get better and better at assigning credit. Maybe they’ll have better models of how scientific progress works, maybe they’ll even have advanced AI. A future government (or benevolent AI, if you’re into that) might decide to buy research impact shares in order to validate important past work.

If you believe that might happen, then you don’t need a track record of government agencies buying research impact shares. As a scientist, you can find a sufficiently futuristically inclined investor, and tell them this story. You can sell them some shares, and tell them that, when the AI comes, they will have the right to whatever benefit it bestows upon your research.

I could imagine some people doing this. If you have an image of your work saving humanity in the distant future, you should be able to use that image to sell something to investors. It would be insanely speculative, a giant pile of what-ifs with no guarantee of any of it cashing out. But at least it’s better than NFTs.